The rise of C-level investigations marks a significant shift in securities enforcement, demanding sophisticated white-collar defense strategies. Securities regulations, enforced by bodies like the SEC, define the legal framework for litigation involving economic crimes, protecting investors and maintaining market integrity. Understanding how these regulations influence outcomes from compliance to jury trials is crucial for successful results in high-stakes cases. Case studies reveal the far-reaching consequences of executive enforcements, offering insights into strategic business considerations for risk mitigation and favorable outcomes.

In an era defined by heightened corporate accountability, C-level investigations have emerged as a powerful tool for securities enforcement. This article delves into the rising significance of these inquiries, exploring how they reshape business practices and legal landscapes. We analyze the profound impact of securities regulations on litigation outcomes, dissecting complex regulatory standards that influence case results. Through real-world case studies, we uncover the far-reaching effects of C-level enforcements, highlighting their role in fostering transparency and deterring corporate misconduct.

- The Rise of C-Level Investigations: A New Era in Securities Enforcement

- Understanding the Impact: Securities Regulations and Their Role in Litigation

- Navigating Complexities: How Regulatory Standards Influence Legal Outcomes

- Case Studies: Examining the Real-World Effects of C-Level Enforcements

The Rise of C-Level Investigations: A New Era in Securities Enforcement

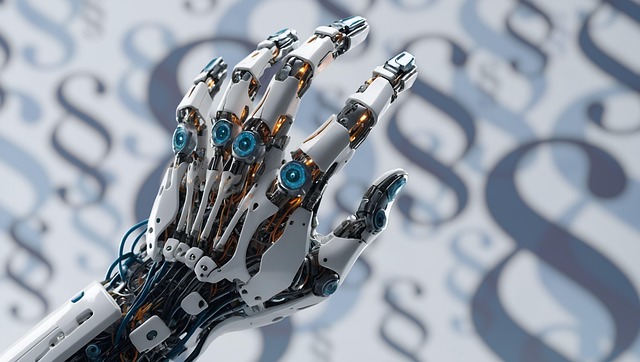

The rise of C-level investigations marks a significant shift in securities enforcement, driving us into a new era where corporate leaders are increasingly held accountable for their actions. These high-profile inquiries, targeting executives at the highest levels, reflect a broader trend towards stricter compliance and enhanced scrutiny within the financial sector. As securities regulations evolve, so too does their impact on litigation outcomes.

White collar defense firms are now called upon to navigate complex legal landscapes, representing both corporate and individual clients in these high-stakes cases. The intricacies of these investigations demand meticulous attention to detail, robust risk management strategies, and a deep understanding of how securities regulations shape legal proceedings. With the stakes higher than ever, successful outcomes depend on navigating a delicate balance between proactive compliance measures and effective legal representation.

Understanding the Impact: Securities Regulations and Their Role in Litigation

Securities regulations play a pivotal role in shaping the landscape of litigation, especially in high-stakes cases involving white-collar and economic crimes. These regulations are designed to protect investors, maintain market integrity, and ensure fair practices within the financial sector. When violations occur, they can have significant implications for businesses and individuals involved, potentially leading to substantial financial penalties and reputational damage.

Understanding how securities regulations impact litigation outcomes is crucial. They serve as a framework that guides investigations, providing clear guidelines on what constitutes acceptable behavior. In cases of fraud or misconduct, these regulations offer a comprehensive set of rules that can strengthen the evidence and increase the likelihood of successful prosecutions. Moreover, they play a vital role in shaping jury trials, ensuring that all parties involved are held accountable under consistent legal standards.

Navigating Complexities: How Regulatory Standards Influence Legal Outcomes

Navigating Complexities delves into the intricate relationship between securities regulations and their profound impact on legal outcomes in C-Level investigations. These regulations, designed to protect investors and maintain market integrity, significantly shape the trajectory of any litigation. The influence is multifaceted; from defining permissible investment practices to setting standards for corporate disclosures, they form a critical framework that guides both legal strategies and eventual verdicts.

Understanding how securities regulations, such as those enforced by bodies like the SEC, impact each stage of the investigative and enforcement process is crucial. This includes everything from avoiding indictment through strategic compliance to navigating jury trials with robust defenses based on regulatory interpretations. The interplay between these factors can be the difference between a favorable outcome and significant legal repercussions for C-Level executives.

Case Studies: Examining the Real-World Effects of C-Level Enforcements

In the realm of C-Level investigations, case studies offer a window into the profound real-world effects of enforcements at the executive level. By examining specific instances where securities regulations have been pivotal, we uncover valuable insights into how these measures influence litigation outcomes. This approach is particularly enlightening when dissecting high-profile cases involving top-tier executives. The impact is often significant, with companies facing severe consequences for non-compliance, including substantial fines and legal repercussions.

These case studies also highlight the strategic considerations that businesses must navigate to avoid indictment and achieve extraordinary results in court. Through meticulous analysis, we see how effective internal controls, robust compliance programs, and proactive disclosure can lead to winning challenging defense verdicts. The interplay between securities regulations and litigation strategies is a dynamic one, where adhering to legal frameworks can ultimately prove pivotal in mitigating risks and securing favorable outcomes.

The surge in C-level investigations marks a significant shift in securities enforcement, underscoring the profound impact of regulations on litigation outcomes. As demonstrated through case studies, strict adherence to regulatory standards can serve as both a deterrent and a catalyst for legal action. Understanding the intricate relationship between securities regulations and real-world consequences is essential for navigating complex cases effectively. By appreciating How Securities Regulations Impact Litigation Outcomes, legal professionals can better equip themselves to defend against, or support, investigations at the highest levels of corporate governance.